Monthly Market Update

Submitted by TLWM Financial on July 1st, 2022

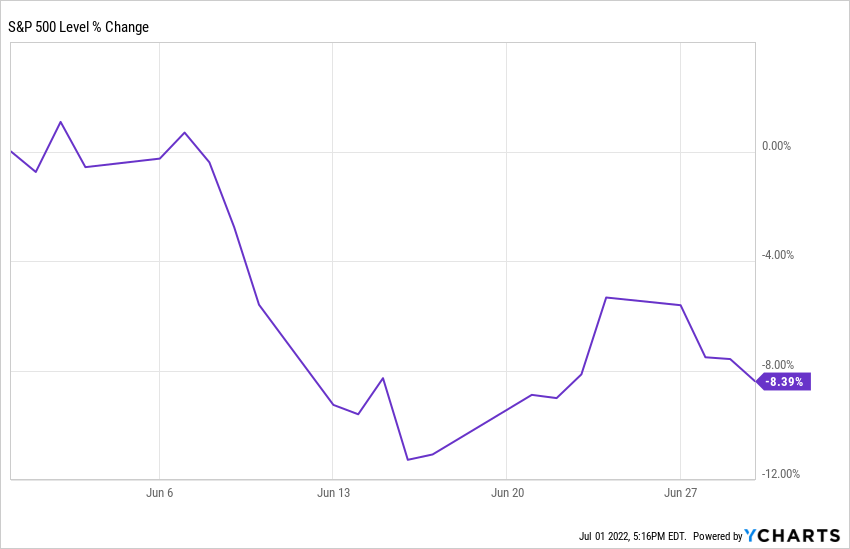

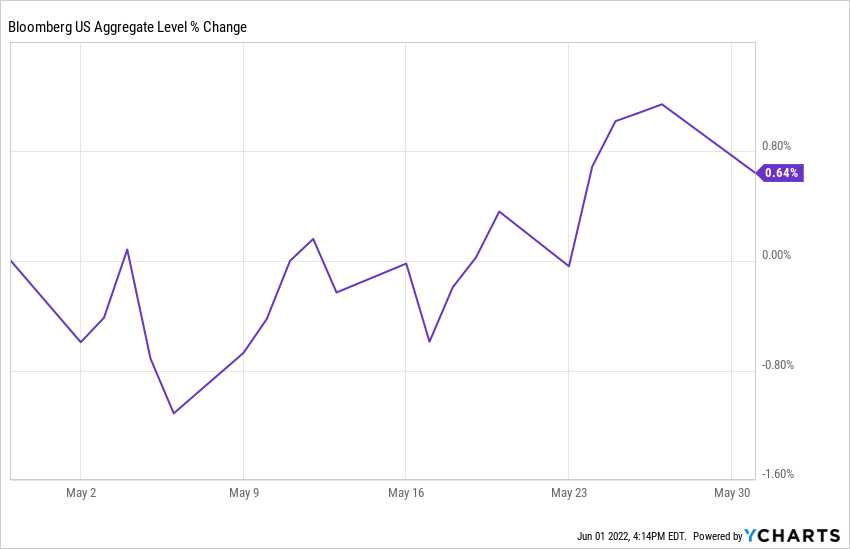

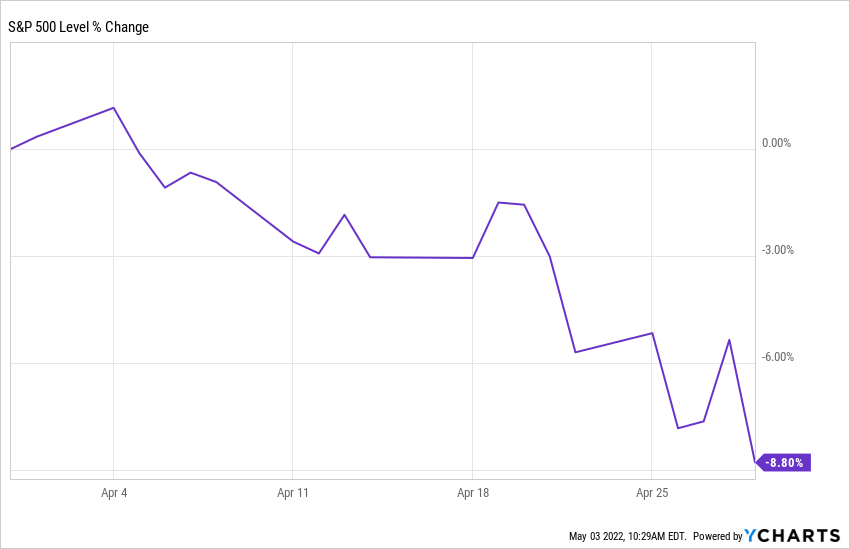

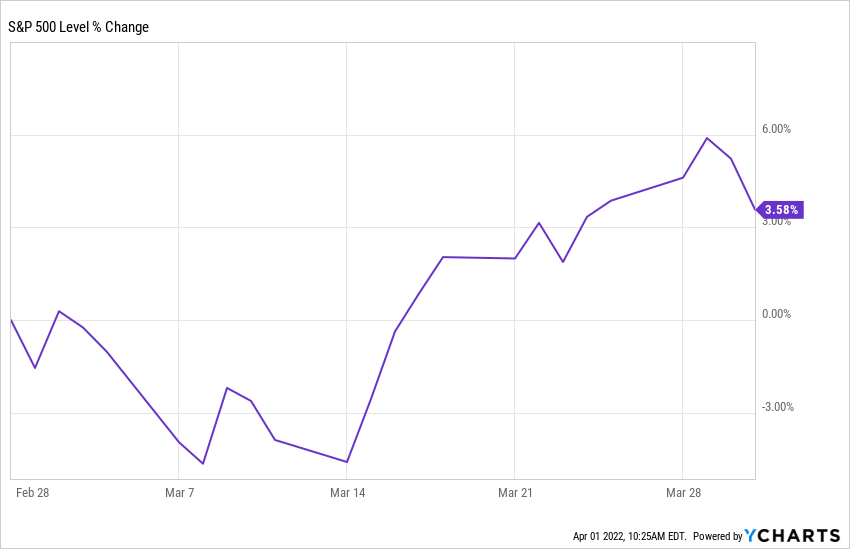

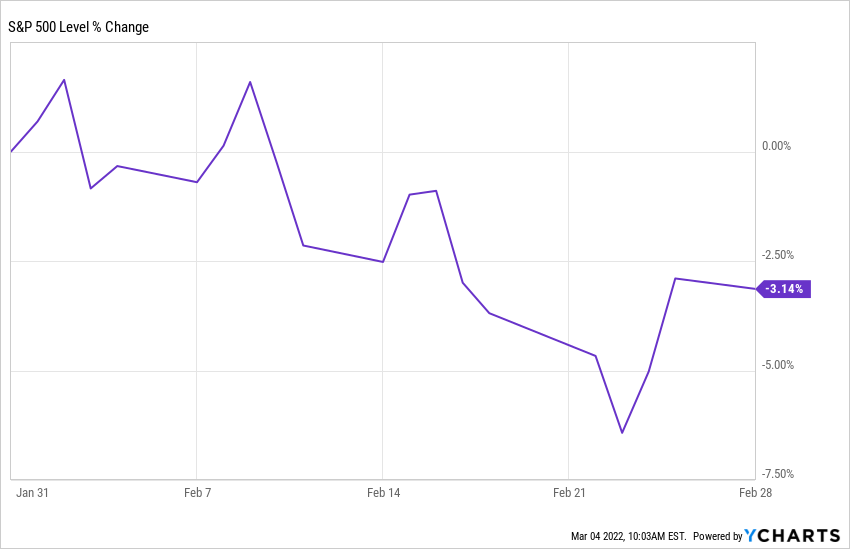

The challenging first half of 2022 is now in the books as the S&P 500 dropped roughly 8% in June bringing the year-to-date return to about -20.5%. While stocks struggled, they were not alone, as most asset classes have been negatively impacted this year, including fixed income, with the US Aggregate bond market down about 11% for the year.

The good news is that we made changes to portfolios in April to manage risk due to the fact that we felt the chances of recession were rising. Thus far, that change has been a good one for portfolios and we continue to have a portion of our growth portfolios defensively positioned today.

.jpg)