Monthly Market Update

Submitted by TLWM Financial on July 1st, 2024

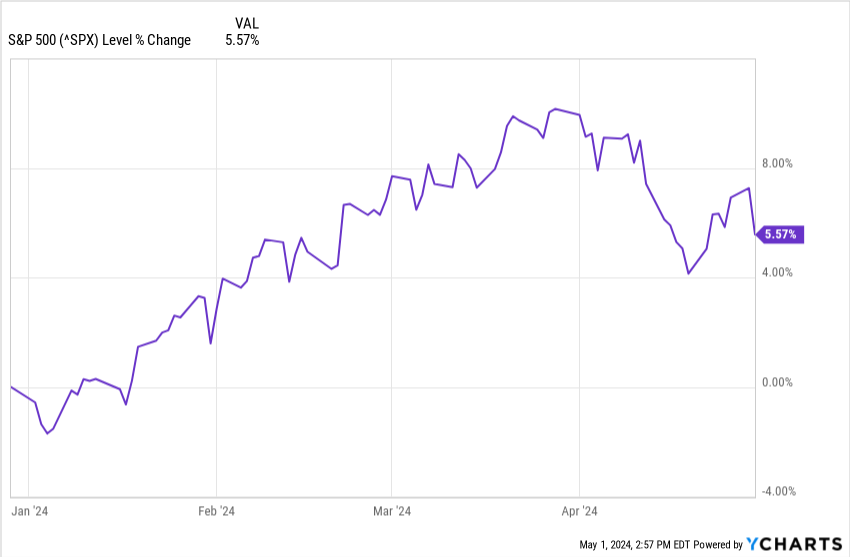

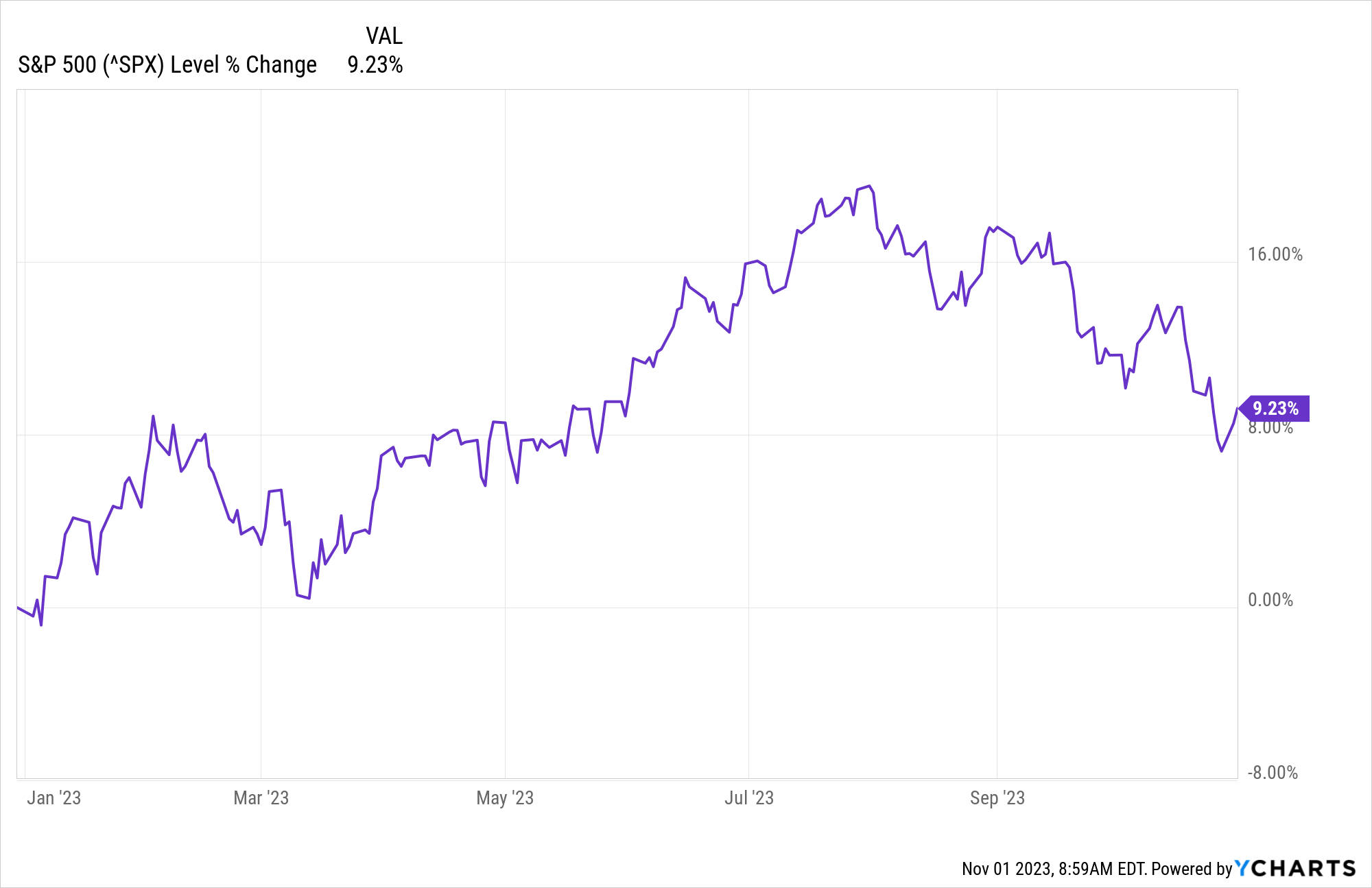

Another positive month of returns for stocks in June brought the first half of the year to a close with the S&P 500 up roughly 3.5% for the month and a very strong 14.5% year to date. (YCharts)

Throughout the year we’ve had portfolios positioned for growth and continue to believe that we’ll likely see stocks move higher over the next 9-12 months. Of course, if our outlook changes, we’ll be ready to make adjustments.

Given that we’re at the half way point of the year we’re going to review the key areas we highlighted in our annual outlook, and what we’re watching from each of these for the back half of the year.