Market Updates

TLWM Market Updates

Economic Dashboard

Submitted by TLWM Financial on July 19th, 2021Monthly Market Update

Submitted by TLWM Financial on July 1st, 2021Monthly Market Update

Submitted by TLWM Financial on June 1st, 2021

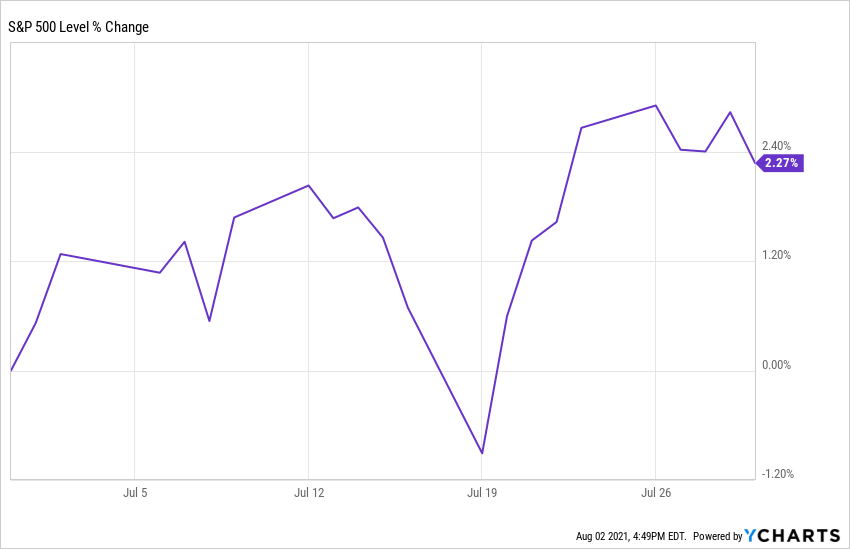

Last month we suggested that the chance for some stock market volatility had increased as our market sentiment indicator was flashing a warning sign. While May started out strong, we saw some volatility as the market pulled back in the middle of the month before bouncing back and finishing the month roughly where we started (YCharts).

Economic Dashboard

Submitted by TLWM Financial on May 17th, 2021Monthly Market Update

Submitted by TLWM Financial on May 4th, 2021Economic Dashboard

Submitted by TLWM Financial on April 26th, 2021Economic Dashboard

Submitted by TLWM Financial on April 19th, 2021Monthly Market Update

Submitted by TLWM Financial on April 1st, 2021Monthly Market Update

Submitted by TLWM Financial on March 2nd, 2021

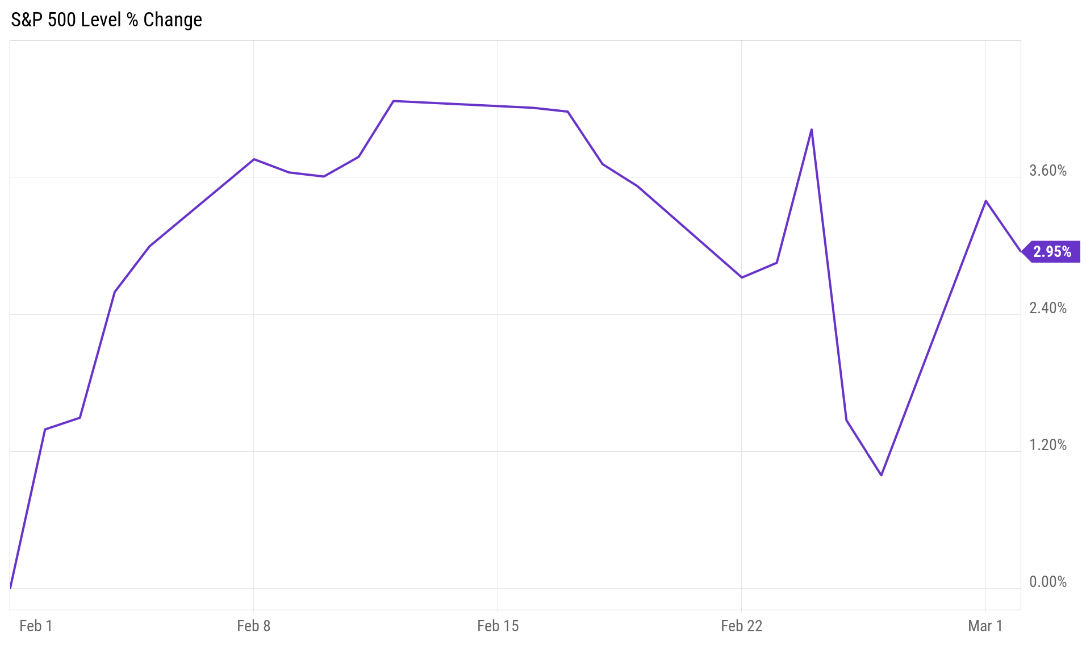

The stock market has been a bright spot in February, despite a choppy end to the month, as stocks were up about 3% (YCharts). Continued positive economic data, increased vaccine distributions, and better than expected earnings likely served as the primary drivers, while the last few days brought some concerns over higher interest rates.